As the Representative for North Carolina House District 97 (Lincoln County), Rep. Saine is serving in his seventh full term in the North Carolina House. He was appointed by Speaker Tim Moore in 2019 to serve as a Senior Chairman of the House Appropriations Committee, which is responsible for preparing the state’s $32 billion dollar budget. He previously served as the Senior Chairperson of the House Finance Committee from 2015-2018 where Chairman Saine passed over $1 billion in tax cuts for working families across North Carolina. Rep. Saine was also the founding chair of the IT Appropriations Subcommittee and the IT Joint Oversight Committee, which has led sweeping reforms and advancements in state IT procurement and security policies.

As we get into the meat of the interview, you hear a man who is passionate about the good side of politics; someone who doesn’t “use” power, he understands it… and makes it work like it should. Through it, he has propelled forward a common-sense approach to growth, business, finance, and relationships. In reality we could have interviewed him all day!

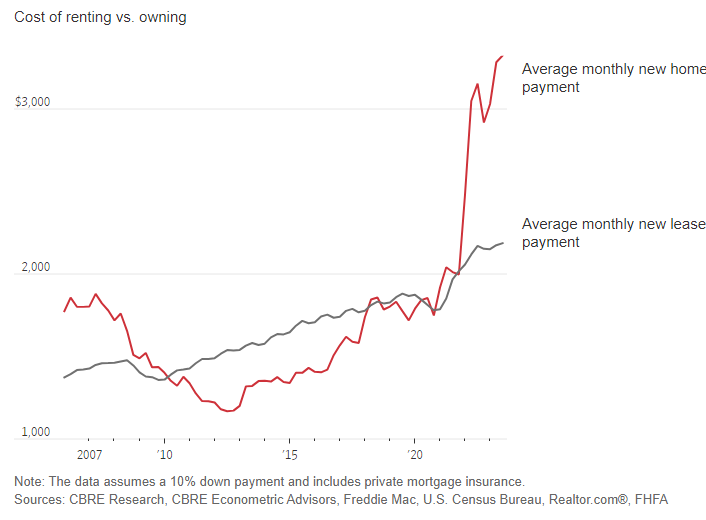

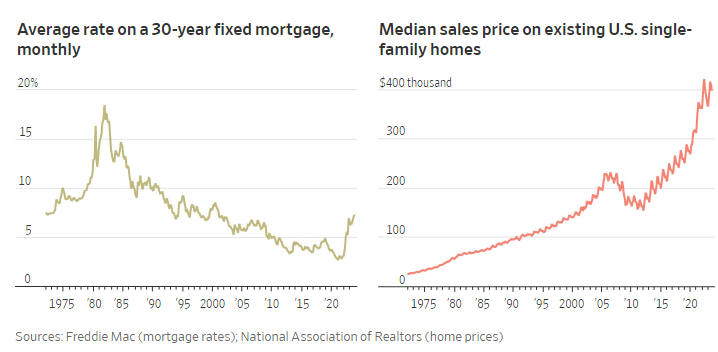

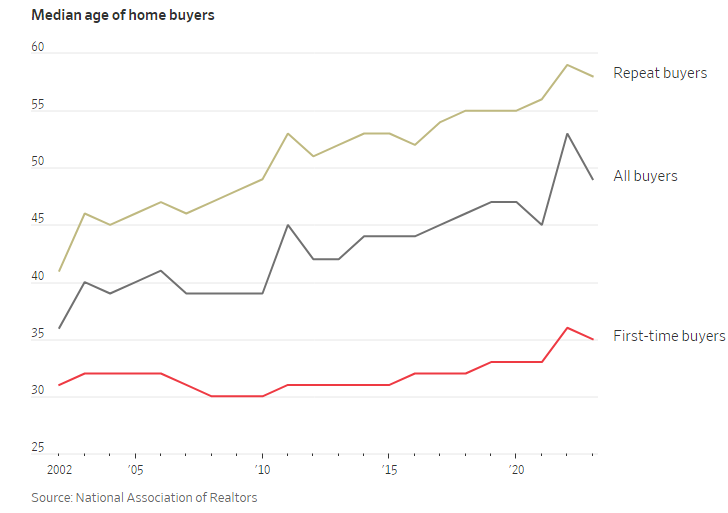

2. Did the Fed Break Homebuying?

As a result, the age of first-time buyers continues to trend upward with no immediate relief in sight.

To read more about how interest rates have affected homebuying, take a look at this article in The Wall Street Journal by Gina Heeb (paywall protected).

My take: While it looks like the Federal Reserve will begin relaxing some of the steps it has taken to curb inflation, the fact remains, it will be a long time, if ever, before we return to interest rates in the 3% neighborhood. Pair that with the lack of housing availability and you have what we have now, the perfect storm of housing that is unattainable for most. Think about this. The average sale price of a home in 1982, when the interest rate was north of 15% was $83,900. That’s $266,772 in 2024 dollars. Today the average sale price is about $389,500. Big difference.

Rob Nanfelt

Executive Director, REBIC