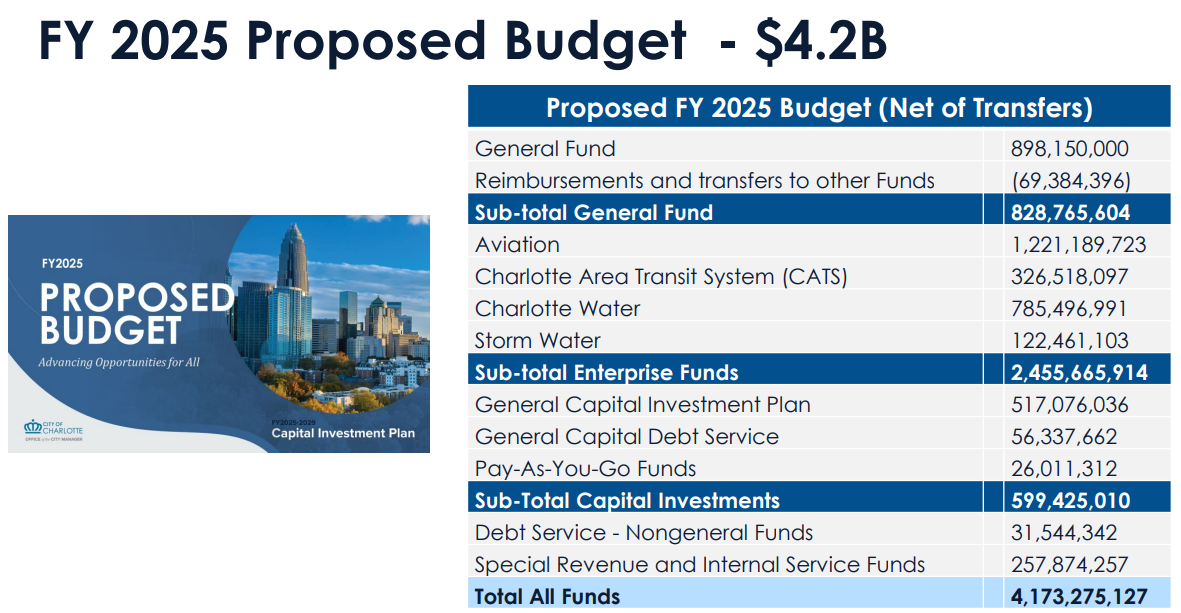

My take: I was there and spoke on behalf of REBIC, the only attendee representing business interests. I noticed this budget seems to have something in it for everyone which I guess is part of the strategy for assuring its passage. Also of note, Affordable Housing is listed as a “Council Key Initiative” along with Mobility and other general priorities. The proposal seeks to double the bond amount but doesn’t appear to answer the ever-important question of how effective those dollars have been thus far in achieving a positive outcome. I find that concerning. On the subject of attainable housing, I find myself confused by the fact that on the one hand the Council seems unwilling to keep a working development option available under the Unified Development Ordinance (UDO), yet willing to spend millions more to correct a problem for which it is partially responsible. My opinion is if there was anything the Council could do that would immediately increase the supply of housing, it would be to reduce the monumental amount of regulatory constraints it has implemented and unleash the free market to do what it does well – meet customer demand.

2. The Impact of Mortgage Rates on Housing Affordability | A Devastating Perspective

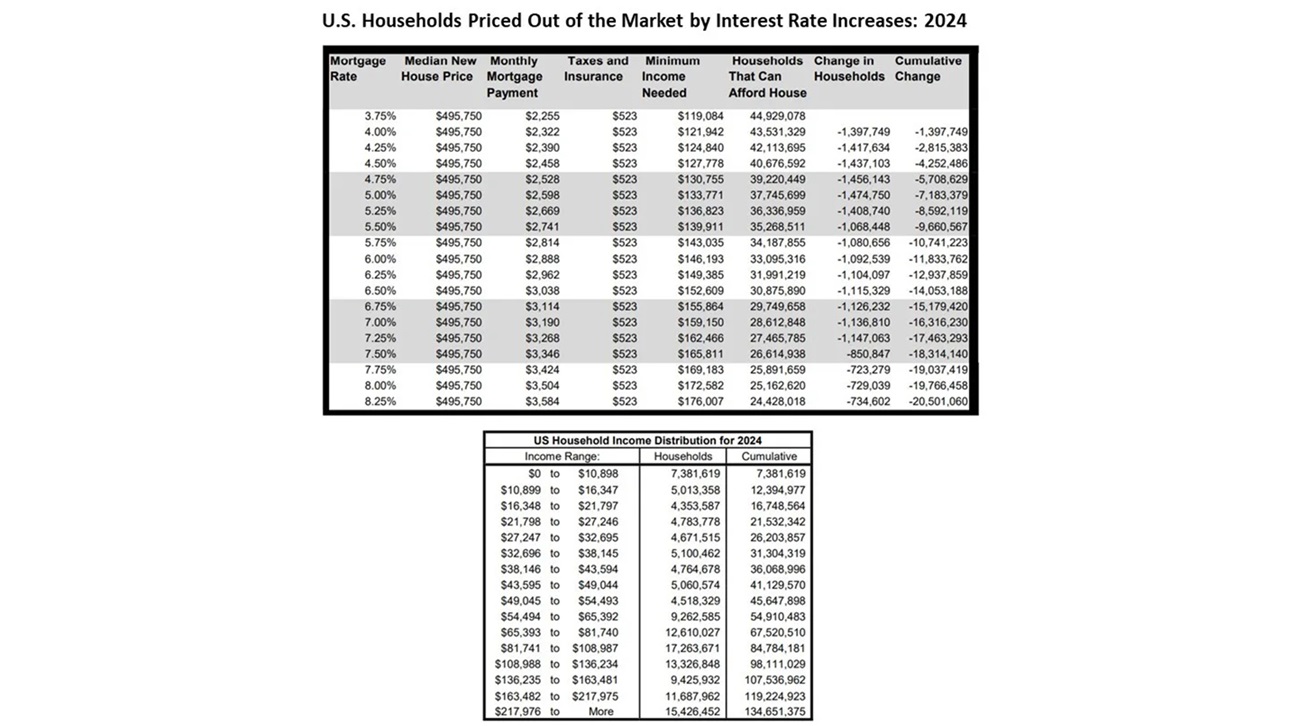

According to the latest press release from Freddie Mac, the average rate on a 30-year fixed-rate mortgage has now risen to approximately 7.25%. Based on NAHB’s priced-out data, at this rate, only about 27.5 million (out of a total of 134.7 million) U.S. households could afford to buy a median-priced new home, based on their incomes and standard underwriting criteria.

As many analysts have noted, interest rates and house prices interact with each other to determine new home affordability. For example, if the costs of producing homes and the resulting prices to buyers were reduced (for instance, by adopting some of the measures in NAHB’s 10-point plan to lower shelter inflation), more than 4.5 million households would be priced into the market by reducing interest rates from 7.25% to 6.25%, which was the mortgage rate in mid-February 2023.

For example, in the table above, approximately 27.5 million households are able to afford the median-priced new home at a 7.25% mortgage rate. If the rate fell back to 6.25%, the table shows an additional 4.5 million (for a total of approximately 32 million) households would be priced into the market.

This change is particularly relevant, as NAHB is currently projecting that the average mortgage rate will be near 6.25% by the end of 2024 — although there is considerable uncertainty around this number, largely because of uncertainty about what monetary policy the Federal Reserve will find necessary to contain inflation. The above table can be used to track the impact actual changes in mortgage rates are having on affordability of new homes over the rest of the year.

Paul Emrath, vice president for survey and housing policy research for NAHB, provides more information in this Eye on Housing post.

My take: The headwinds against affordable home ownership relief appear to be particularly strong right now. Just today, at the Foreign Bankers’ Association meeting in Amsterdam, Fed Chair Jerome Powell indicated interest rates are falling more slowly than expected and rates will remain elevated for an extended period of time. So, what can we do to ease the burden and provide more opportunities for first-time homebuyers and others in similar circumstances? For one thing, local governments can stop micromanaging and overregulating nearly every element of the development, design, and building process.

Rob Nanfelt

Executive Director, REBIC