Transportation, Planning, & Development

Agenda – Video (29:10 – 1:41:02) – Presentation

Planning Director Alyson Craig provided a presentation containing a staff recommendation in response to a referral made by City Council earlier last year. It’s important to note that the Council adopted the 2040 Comprehensive Plan in 2021 which called for broader allowance of higher density dwellings throughout the city. The adoption of the Unified Development Ordinance (UDO) followed in 2022 and permitted the development of duplexes and triplexes in single-family neighborhoods. After complaints from some neighborhood groups, who seem to have been deemed by the leadership as having the most influence on a plan already debated by experts, Council directed staff to develop proposals aimed at slowing and potentially repealing these provisions. Further discussions will take place at the next two UDO Advisory Committee meetings to be held next week and the week after.

Jobs & Economic Development

Agenda – Video (2:04:40 – 3:23:25) – Presentation

Economic Development Director Tracy Dodson provided a presentation on a potential pilot project involving the proposed conversion of one or more buildings in Uptown. Staff will have additional discussions and come back to Council with a menu of incentive options that may include tax increment financing, tax increment grants, and other similar related tools.

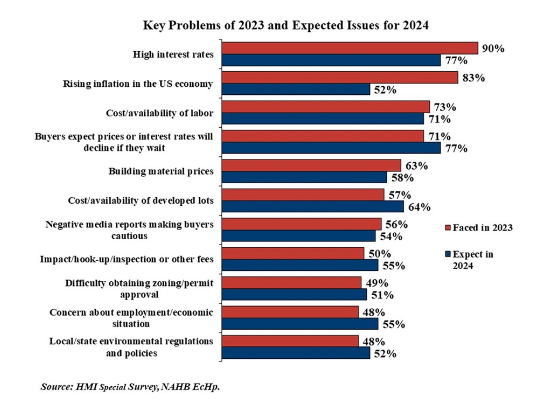

2. Many Top Concerns for Builders in 2024 Seem to Stem From Burdensome Regulation

According to the January 2024 survey for the NAHB/Wells Fargo Housing Market Index (HMI), high interest rates were a significant issue for 90% of builders in 2023, and 77% expect them to be a problem in 2024. The second most widespread problem in 2023 was rising inflation, cited by 83% of builders, with 52% expecting it to be a problem in 2024.

Concerns over the cost and availability of labor have increased significantly in recent years, rising from only 13% of builders in 2011 to its peak at 87% in 2019. Fewer builders reported this problem in 2020 (65%), but the share rose again in 2021 (82%) and 2022 (85%). The share eased slightly in 2023 to 74%, and 75% expect the cost and availability of labor to remain a significant issue in 2024.

The share of builders experiencing significant problems with building materials prices has fluctuated over the years as well, reaching as low as 33% in 2011 to a peak of 96% in 2020, 2021 and 2022. The slowdown in single-family construction in 2023 made this less of a problem for builders last year, with 63% reporting it as a significant issue. Fewer (58%) expect it to remain an issue in 2024.

Compared to the supply-side problems of materials and labor, problems attracting buyers have not been as widespread, but builders expect many of them to become more of a problem in 2024. Buyers expecting prices or interest rates to decline if they wait was a significant problem for 71% of builders in 2023, with 77% expecting it to be an issue in 2024. A majority of builders (56%) also cited negative media reports making buyers cautious as a significant issue that is expected to continue in 2024.

NAHB Senior Economist Ashok Chaluvadi provides more details in this Eye on the Economy post, as well as a download to the full survey report.

Rob Nanfelt

Executive Director, REBIC

Notifications